Letter to Policyholders

April 2, 2024

FOCUS | MINDSET | INNOVATION

A Message from the Chair of the Board and the President and Chief Executive Officer

Dear Valued Policyholder:

Thank you for trusting Security Mutual Life to help support your efforts in building a more secure financial future for you and your loved ones. Since our founding in 1886, it has been our goal to help provide you with peace of mind in uncertain times and an ever-changing world.

Security Mutual Life has persevered through recessions, wars, and pandemics to emerge, and remain, a financially strong and well- respected life insurance company. As a mutual life insurance company, Security Mutual Life is operated and maintained for the benefit of you, our policyholder.1 This is a commitment that is part of our culture.

Our continued commitment to our policyholders is demonstrated through our focus, mindset and innovation.

A FOCUS on the Strength of Our Company…

Financial Results

In 2023, Security Mutual Life continued its strong sales and issued more than 40,800 new individual life insurance policies and annuity contracts. Annuity sales exceeded expectations, driven by the rising interest rate environment. This growth has been accomplished without compromising the standards that have been the key to our financial results.

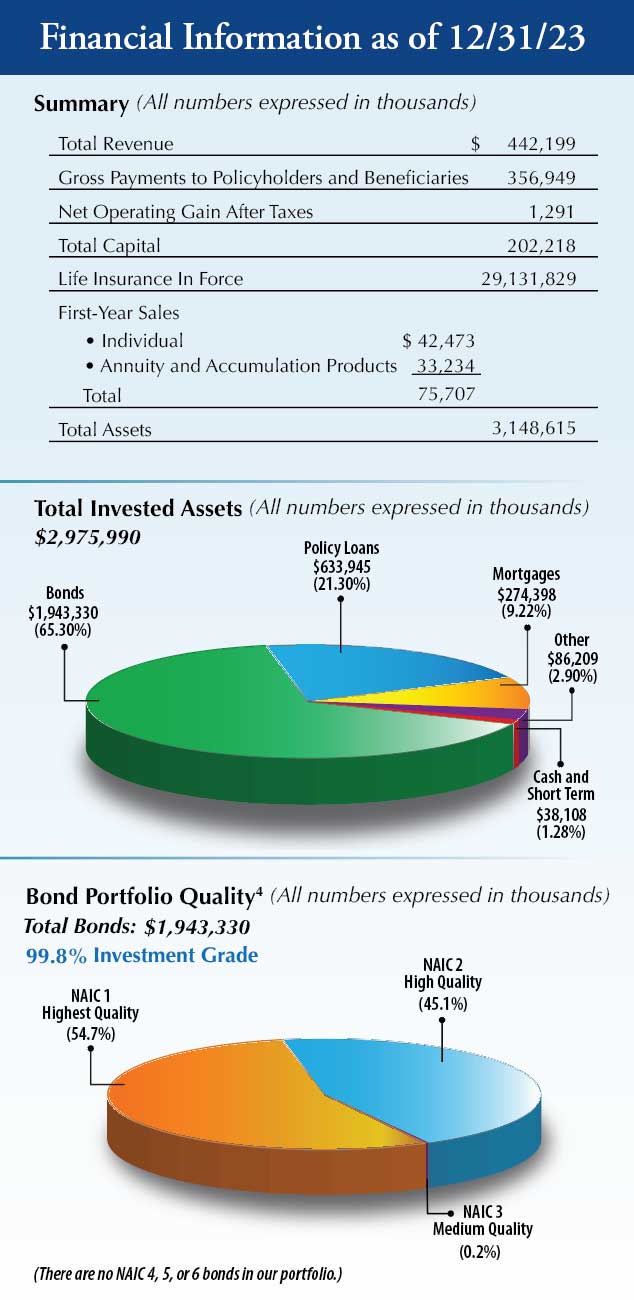

With Security Mutual Life’s financial strength and stability, the Company remains well-positioned to navigate current economic conditions despite the continuation of excess mortality levels experienced since the COVID-19 Pandemic. In 2023, the Company achieved favorable financial results by focusing on optimizing its operating model to drive sustainable growth. The Company continued to execute on its strategy to increase capital efficiency and enhance its capabilities through technology and innovation, to better serve our policyholders. The Company closed 2023 with $202.2 million in capital and assets over $3.1 billion. Our 2023 net operating gain of $1.3 million was achieved after paying policyholder benefits in excess of $356.9 million, including policyholder dividends2 of $20.0 million.

Financial Strength & Investing for the Future

Security Mutual Life works with BlackRock Financial Management, Inc.,3 to manage the Company’s fixed income investment portfolio. Security Mutual Life and BlackRock developed and pursued strategies that focus on enhancing income and reducing market sensitivity, while managing portfolio risk to support our products, and create long-term value for our policyholders.

Security Mutual Life internally manages its commercial mortgage loan portfolio (see the Total Invested Assets chart) which is secured by high-quality real estate. Through stringent commercial mortgage underwriting standards, monitoring procedures and diversification (both as to real estate type and geography), the portfolio has reflected a very favorable experience over many years.

Although inflation has moderated in recent months, 2023 saw uncertainty in markets as the Federal Reserve continued its efforts to reduce and control inflation. The Company’s diversified portfolio performed well throughout the year. Even in a challenging economic environment, the Company has been managing its assets in a stable manner with the goal of generating the returns needed to meet policyholder commitments.

In 2023, Security Mutual Life continued to focus on its objectives of achieving a favorable level of investment income as well as preserving capital, by maintaining a high-quality portfolio that is well-positioned to withstand market and economic volatility.

A 21st Century MINDSET…

The Company That Cares® In Action

Security Mutual Life believes in the importance of providing meaningful support to a diverse group of charitable initiatives throughout our communities. Whether it’s civic organizations, food pantries, disaster relief, or other various causes, we are dedicated to providing important assistance that supports building a better future. Our workforce exemplifies a culture of caring and Security Mutual Life is proud and appreciative of the many contributions, including volunteerism, that our employees make inside and outside of the workplace supporting a better tomorrow.

Within the Security Mutual Life Foundation, our nonprofit initiative, Sock Out Cancer®, continues to assist financially distressed cancer patients and their families through funds raised and provided to hospital foundations who then pay for non-medical necessities such as food, transportation, and housing, so that patients can focus their energy on fighting cancer. Since its inception in 2017, Sock Out Cancer has distributed $1.6 million to participating hospital foundations and other charitable organizations.

Agile Workforce and Expanding Operations

In the past four years, Security Mutual Life has undergone a workplace transformation. To better serve our employees and policyholders, we have implemented contemporary workplace policies and technologies that facilitate a variety of flexible work arrangements. This flexibility has allowed us to expand our talent pool and welcome highly qualified and diverse employees to our workforce to best serve you.

As we continue to position our organization for success, we are focused on driving growth across the country. In 2023, we opened a new regional office in Houston, Texas. Houston was strategically selected because of its central location, ease of accessibility, and large talent pool. These elements align with our goals of supporting our expanding distribution footprint and providing a superior customer experience.

As The Company That Cares® with a 21st Century mindset, we care about how we serve you, our policyholder, from our strong workforce, and expanding operations and distribution, to our overall support of our communities.

A COMMITMENT to Innovation…

Emphasis on Information Technology Investments and Cybersecurity

In today’s ever-changing digital landscape, continued technological advancement and the protection of confidential information are critical for any financial services company.

At Security Mutual Life, we place the utmost importance on cybersecurity and personal information privacy protection programs. We continue to invest in state-of-the-art technology platforms to help protect against sophisticated cybersecurity threats. To address the ever-evolving cybersecurity threats, our employees undergo regular security awareness training, and our policies and programs are reviewed frequently.

Additionally, Security Mutual Life is constantly evaluating the Information Technology landscape and utilizing new technologies to provide policyholder value, while understanding how advances in emerging technologies, such as Artificial Intelligence, might be best utilized.

Products Designed With You In Mind

As the life insurance industry evolves, Security Mutual Life continually evaluates, refines, and enhances our product portfolio to continue to provide offerings that are well-suited for our policyholders and life insurance advisors.

With a dedication to innovation, we continue to invest in technology, product development and services that support our commitment to you.

Conclusion

2023 was another successful year for Security Mutual Life. Through focus, mindset and innovation, we build on our established strengths and advance through innovation and investment, while appropriately managing new and existing risks through our robust Enterprise Risk Management (ERM) framework. Additionally, in 2023 the Company paid policy dividends to participating policyholders, as we have done consecutively every year since 1893. We continue our commitment of helping our policyholders meet today’s and tomorrow’s insurance and financial needs by providing innovative solutions, products, services and a meaningful customer experience.

Thank you for putting your trust in Security Mutual Life and we look forward to continuing to serve you.

Bruce W. Boyea

Chair of the Board

Kirk R. Gravely

President and Chief Executive Officer

Security Mutual's 2023 Financial Charts

You can download the 2024 Letter to Policyholders here.

To view the Company’s privacy notice, please click here.

1The annual election of Directors will be held at the Home Office in Binghamton, N.Y. on the first Tuesday in February. Polls will be open from 10:00 a.m. to 4:00 p.m. and any policyowner whose policy is in force, and has been in force for no less than one year, is entitled and invited to vote at such an election, either in person or by mail. Pursuant to New York Insurance Law Section 4210, groups of policyowners and contract holders have the right to make independent nominations five months prior to the election.

2 The payment of dividends is not guaranteed, and the amount credited, if any, may rise and fall depending on experience factors such as investment income, taxes, mortality and expenses.

3 BlackRock Financial Management, Inc., manages $10 trillion of assets as of 12/31/2023. BlackRock is one of the largest U.S.-based external managers of insurance company general account assets, overseeing over $500 billion as of 12/31/2023.

4The National Association of Insurance Commissioners (NAIC) employs a bond-rating system ranging from 1 – 6, with NAIC Classification 1 defined as Highest Quality, NAIC Classification 2 defined as High Quality, and NAIC Classification 3 defined as Medium Quality. Classifications 4 – 6 range from Low Quality to In or Near Default.